Are you looking for a good and reliable solution to your financing needs? Are you specifically looking for a mobile lending app that is both fast and convenient? If so, the Haki Money loan app may be the right choice for you.

In this guide, I’ll walk you through the ‘Haki Money’ loan application, diving in depth into its features, its advantages and contrasting them to its disadvantages.

Before we begin, please note;

Daily Hub is not affiliated with this lending platform in any way whatsoever. The views expressed in this article are a result of basic research and due diligence. Therefore, as much as we strive to provide helpful information, we strongly emphasize that this is not financial advice. With that out of the way, let’s dive in;

Important information about the Haki Money loan app

The Haki Money loan app was first released on 10th September 2022, by Zamaradi Capital & Credit Group LTD and has been receiving regular updates ever since.

The application is compatible with any Android phone with an operating system above Android 5.1+ and it is also rated for 3+, meaning that it has been scanned and validated to be free from any form of obscene content.

Haki Money mobile-based lending platform offers 24/7 support to its clients so that you never have to be stuck in matters related to requesting a loan. Get them through their service email: [email protected]

This lending organization is located in Nairobi Kenya, more specifically in Galana Plaza, in Roysambu – Kasarani District.

Here is what you need to know before you apply for a digital loan from the Haki Money loan app:

| Access Application | Google Playstore |

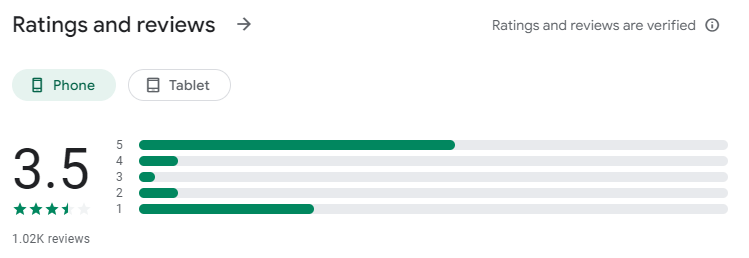

| Playstore Rating | 3.5/5.0 |

| Download Size | 6.2 MB |

| Required OS | Android 5.1 upwards |

| [email protected] | |

| Developer email | N/A |

| Offered By | Zamaradi Capital & Credit Group LTD |

| Haki Money USSD Code | None (N/A) |

| Service fee | 1% to 4% of loan |

| Loan limit (KES) | Up to Ksh.300,000 |

| Annual Percentage Rate (APR) | Interest + Origination Free = 36% |

| Repayment window | 3-24 months |

| Additional charges | Defaulters’ penalty No Hidden Fees |

| Age Limit | 18 years |

| Minimum Requirements | Kenyan Residency Monthly source of income Have a bank account |

| Repayment Method | Paybill: Check Inside App |

Attention: Mojacredit Loan App Review.

How to apply for a Haki Money loan on your smartphone

- Download and install the Haki Money loan mobile app from the Google Playstore.

- Notice of terms, conditions and privacy policies will appear on your screen. Make sure you read and if you agree, click Agree and continue.

- The Haki Money loan app will need to access six permissions from the ones listed above. Allow all and continue. These permissions are:

- Phone access

- SMS

- Location

- Contacts

- Camera

- Enter your phone number and obtain an OTP code that you will receive through SMS. Proceed to the next window.

- You will then be directed to the main dashboard. Click on ‘Apply Now’.

- Fill in your profile, personal and contact details accurately. This information will be used to determine your approval. Click Next

- Set your login password. Make sure your password is strong, to evade malicious account access.

- Apply for your loan depending on the loan limit you have received.

- Your loan will be deposited INSTANTLY upon approval.

Note: This procedure may vary depending on the update. However, the general idea is still the same.

User Reviews

Positive Reviews

The app works well but It forces the limit on you without choice. Also, the customer care lines never work. Work on better interest rates and allow people to choose the amount they need, not the forced limit.

3/5 star rating by P.MGood. The loan disbursement is prompt. The app accesses your metropol credit though before the loan is given. Of course, the service charge fee is too high. 2000 loan, you receive 1340. That’s less service charge of 660. On payment, the full principal of 2k is needed. Do the math, 1320 deductions. You only gained 780. Shylock camouflaged. But I guess you need the money desperately My 2 cents, pay off if you can be free. Borrow from a friend, fuliza, hustler fund, KCB Mpesa etc Low interest.

4/5 star rating by F.NVery good and easy to understand, has low-interest rates, is effective and efficient, and has good room to increase the limit. It’s very easy to operate, it takes a short time for one to get money after successful application .it gives various options such as business, personal and emergency loans.

5/5 star rating by PNMNegative Reviews

It’s a good loaning app but the problem is customer service lines are all off. They have no pay bill or till to send the money in partial payments. One cannot just wake up and get that cash in the deadline and pay off. Kindly in case there’s a pay bill, share so we can make partial payments.

2/5 star rating by H.M